If you are a married or divorced woman, you need to know about the Spousal Benefit. Over 90% of Spousal Benefit checks sent every month by Social Security are sent to married or divorced women. While more women are taking advantage of this incredible tool, many still don’t understand it or know about it. Used properly, the Spousal Benefit can generate tens of thousands of dollars in extra Social Security income. If not used properly, it could end up costing you tens of thousands of dollars in lost benefits.

What is the Spousal Benefit?

The Spousal Benefit allows one spouse, at their Full Retirement Age, to receive a benefit equal to 50% of their spouse's – or ex-spouse's – Social Security Full Retirement Age benefit amount. While this is clunky to write, it’s pretty straightforward to illustrate with an example.

An Example

The Breakdown

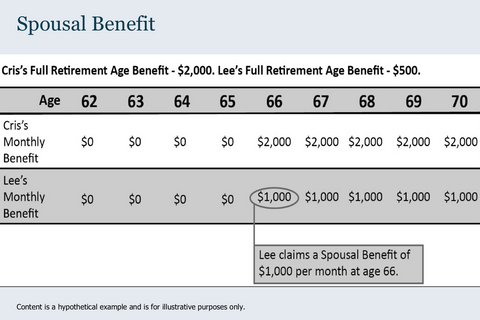

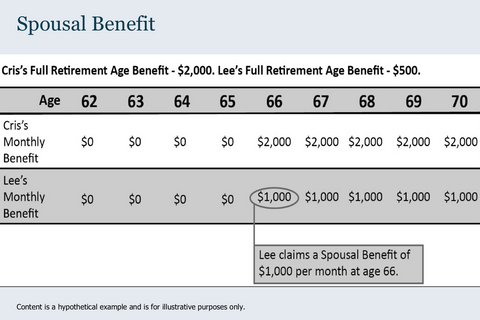

Let’s consider married couple Cris and Lee. They are both the same age, and both claim their benefits at their Full Retirement Age of 66.

At Cris’s Full Retirement Age of 66, his Social Security benefit is $2,000. At Lee’s Full Retirement Age of 66, her Social Security benefit is only $500.

After Cris claims his benefit at age 66, Lee can file for a Spousal Benefit. Lee would then receive 50% of Cris’s Social Security benefit. That works out to be $1000 per month ($500 + ($2000/0.5)).

Because Lee can claim a Spousal Benefit, she doubled her monthly Social Security income. It went from $500 per month to $1,000 per month. Lee claiming a Spousal Benefit will have no impact on the amount of Cris’s Social Security benefit. He will still receive $2,000 per month at age 66.

In this case, because Lee can claim a Spousal Benefit, she increased her annual Social Security income by an additional $6,000 per year. Without the Spousal Benefit, Lee would only be able to claim her own benefit of $500 per month. That works out to $6,000 ($500 x 12 months) for the year. But because Lee can claim a Spousal Benefit of $1,000 per month, she doubled her annual Social Security income. It went up to $12,000 per year ($1,000 x 12 months).

Some Key Points

Now there are a couple of key points to understand.

In order for a wife to file for a Spousal Benefit, her husband must have already filed for his own Social Security benefit. Additionally, you can claim a Spousal Benefit anytime between age 62 and your Full Retirement Age.

However, filing for a Spousal Benefit before your Full Retirement Age will reduce the amount you will receive. In other words, you will receive a Spousal Benefit amount that is less than 50% of your husband’s Full Retirement Age benefit amount. But if you wait until your Full Retirement Age to claim a Spousal Benefit you will receive an amount equal to 50% of your husband’s Full Retirement Age benefit amount. You will only be eligible to receive a Spousal Benefit if the Spousal Benefit is bigger than your own benefit. If your own Social Security benefit is bigger than the Spousal Benefit, you will only be eligible to receive your own.

Chart 2

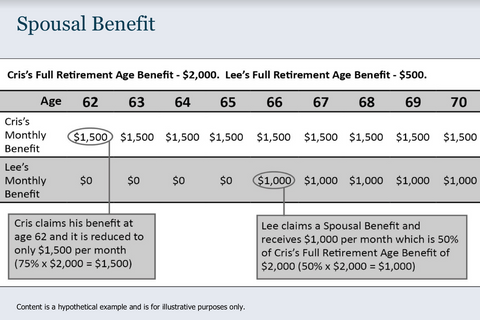

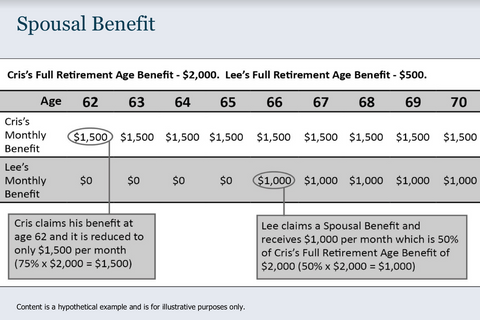

Also consider the size of your Spousal Benefit. It is not impacted when your husband claims Social Security.

Let's use the same benefit amounts from the previous example. What happens if Cris, instead of claiming at age 66, claims his benefit at age 62 instead? You can see in the above chart. Because Cris claimed his benefit prior to his Full Retirement Age, it is reduced to $1,500 per month at age 62. Lee likes her job and decides to work until her Full Retirement Age of 66. Because Lee continued to work she decided to claim her Social Security benefits when she retires at age 66. Lee retires and claims her Social Security at age 66 and she still receives a monthly benefit of $1,000.

How the Spousal Benefits works in the Example

You would think that because Cris claimed his benefit early at age 62 and his benefit was reduced to $1,500, when Lee claimed her benefit at age 66, she would receive a Spousal Benefit amount equal to $750 per month, which is 50% of Cris’s benefit ($1,500 x 50%). But the fact that Cris claimed his benefit early and it was reduced to only $1,500, has no impact on the amount of the Spousal Benefit Lee receives. Because Lee waited until her Full Retirement Age to claim, she is still entitled to receive 50% of Cris’s Full Retirement Age benefit of $2,000 or $1,000 per month ($2,000 x 50%).

The same is true if Cris had waited until he was age 70 to claim his benefit. If Cris waited until age 70 to claim, the amount of the benefit he would receive is increased to $2,640 per month. Once Cris claims his benefit, if Lee is at her Full Retirement Age or older, and she claims a Spousal Benefit, the amount of the Spousal Benefit Lee will receive will still be 50% of Cris’s Full Retirement Age benefit or $1,000 per month ($2,000 x 50%). Lee will NOT receive a Spousal Benefit equal to 50% of Cris’s age 70 benefit of $2,640.

The Husband's Full Retirement Age

The amount of the Spousal Benefit is based on your husband’s Full Retirement Age benefit, regardless of when he claims his own benefit. Assuming your husband has the bigger benefit, he can claim his benefit prior to his Full Retirement Age or after his Full Retirement Age and your Spousal Benefit will still be based on his Full Retirement Age benefit amount.

In this example even if Lee never qualified for her own Social Security benefit, in other words her own monthly Social Security benefit was $0, Lee would still be able to claim a Spousal Benefit and receive a monthly benefit equal to $1,000 if she waited until her Full Retirement Age to claim it.

Divorced women in many cases can also file for a Spousal Benefit.

Spousal Benefit Requirements

To be eligible for a Spousal Benefit and receive up to 50% of their ex-husband’s Full Retirement Age benefit amount, she must meet certain qualifications:

- You were married to your ex-husband for at least 10 years before your divorce.

- You did not re-marry.

If you meet those two criteria and the Spousal Benefit is greater than your own benefit, then you can claim a Spousal Benefit and receive a monthly benefit equal up to 50% of your ex-husband’s Full Retirement Age benefit amount.

When you met the two criteria and have been divorced for two years or more, it gets even better. The ex-husband only has to be eligible to receive Social Security for the woman to claim a Spousal Benefit. In other words, if your ex-husband is age 62 or older, you could still claim a Spousal Benefit. This is true even if he hasn’t filed for his own Social Security benefits. This doesn’t impact your ex-husband’s Social Security benefit at all, he will still receive his full benefit amount. You are not required to notify him at all, in fact.

Social Security’s Spousal Benefit is an incredible feature. It is important you are aware of how it works. That way, you get every dollar of benefit you are entitled to.